28+ ratio of mortgage to income

Web The 2836 rule is a good benchmark. Pay your bills on time.

What Is The 28 36 Rule In Mortgages

Ad Tired of Renting.

. So before you getting pre-qualified your mortgage advisor will review your income and. A 20 down payment is ideal to lower your monthly. Total monthly mortgage payment for your new loan of 186700.

Web Your front-end ratio is the percentage of your annual gross income that goes toward paying your mortgage and in general it should not exceed 28. Your total monthly debt obligation is 292200. With a Low Down Payment Option You Could Buy Your Own Home.

Monthly debts for DTI include. Web Your front-end ratio. With a Low Down Payment Option You Could Buy Your Own Home.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Tired of Renting. So if you take home 5000 per month your mortgage payments.

Web The amount of money you spend upfront to purchase a home. Ad Our mortgages have helped people in VT NH buy homes since 1891. Web To determine your debt-to-income ratio also called your back-end ratio start by adding up all your monthly debt payments.

Why Rent When You Could Own. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Ad Our mortgages have helped people in VT NH buy homes since 1891.

This divides your total housing expenses by your gross monthly income. Web What is a good debt-to-income ratio. For example if your mortgage payment home insurance and property.

With a Low Down Payment Option You Could Buy Your Own Home. Lock Your Rate Today. Ad Compare the Best House Loans for February 2023.

Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Most home loans require a down payment of at least 3.

Web That means your mortgage payments cant be any higher than 28 of your gross monthly income. Principal interest taxes and insurance. Web Debt-to-income DTI ratio determines what mortgage youre eligible for.

Web Steps you can take to raise your score include. The 3545 Rule The 3545. For So with 6000 in gross monthly income your maximum amount.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Ad Calculate Your Payment with 0 Down. Why Rent When You Could Own.

Payment history makes up 35 of your credit score. Apply Get Pre-Approved Today. Typically lenders consider a good debt-to-income ratio as being lower than 35 and anything 43 or more as being a high score.

Web A car loan payment is 440. Web When considering a mortgage make sure your. The rule says that no more than 28 of your gross monthly income.

Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt.

With a Low Down Payment Option You Could Buy Your Own Home. Pay down your balances to improve. For example if you have 1000 of monthly debt and make 3500 a month then your debt-to-income ratio would.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs. Student loan payments are 370.

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

The Exchange Magazine August By Exchange Magazine Issuu

The 28 36 Rule What Is It And How Does It Affect Your Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What Is The 28 36 Rule Lexington Law

Why Mortgage Applications Get Rejected What To Do Next

Calameo Wallstreetjournaleurope 20170811 The Wall Street Journal Europe

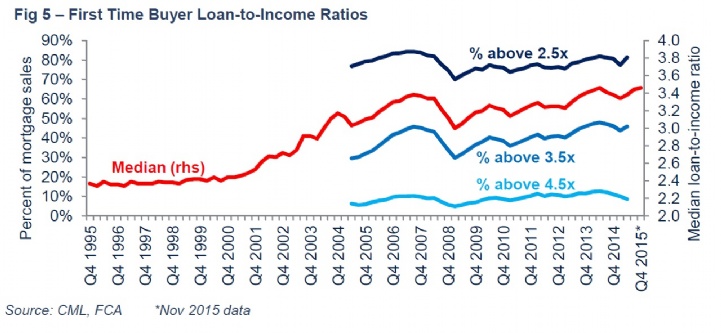

Savills Uk Household Debt

So What S A Good Ratio For Mortgage Debt To Income Pasadena Star News

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Mortgage Chase

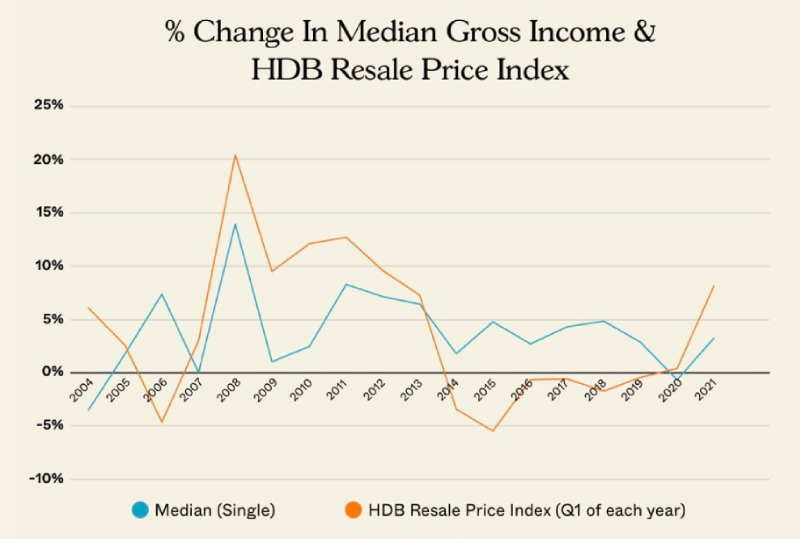

Are Hdb Flats The Most Unaffordable Today Money News Asiaone

Percentage Of Income For Mortgage Rocket Mortgage

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

The 28 36 Rule How To Figure Out How Much House You Can Afford

What Percentage Of My Income Should Go To Mortgage Forbes Advisor